USANewsGroup.com Market Intelligence Brief –

The ‘Global Village’ is dead. What killed it wasn’t a virus or a war—it was trust collapse. In 2026, nations aren’t just closing physical borders; they’re slamming digital gates shut, locking down data pipelines, cutting dependency chains, and building walls around their most critical infrastructure.

The ‘Everything Bubble’ has finally popped. Stock buybacks can’t save you. Debt can’t be papered over. What’s left standing are the Hard Assets and Sovereign Infrastructure—the companies that control the gateways to government security, defense supply chains, and medical reality.

This isn’t about speculation anymore. It’s about survival positioning. The only safe money in 2026 is in the companies governments must buy from to stay operational.

The firms that hold the keys to encrypted communications.

The miners who control the metals that make missiles, EVs, and grid batteries possible.

The biotech labs that can respond when the next pathogen crosses a border.

Paper wealth is dying. Physical control is the new currency. And five companies are locking down the choke points right now.

THE DIGITAL FORTRESS – CSE: QSE

Quantum Secure Encryption Corp. (CSE: QSE) (OTCQB: QSEGF) (FSE: VN8)

Governments are panic-buying Post-Quantum security because they know what’s coming: Q-Day—the moment quantum computers crack every encryption standard protecting state secrets, military communications, and financial infrastructure. When that day arrives, nations without quantum-resistant systems will be digitally naked.

QSE just proved it’s not selling snake oil. On February 3, 2026, the company announced a 3-Year Security Deal with the Brazilian Government—a sovereign power entrusting QSE to lock down its internal communications. The contract covers 4,500 user licenses in Year 1 alone, with an initial value of US$150,000. But this isn’t a one-and-done transaction. It’s a ‘land and expand’ deal for QSE’s Single Sign-On (SSO) platform, meaning Brazil is opening the door for QSE to embed itself deeper into the country’s digital infrastructure over time.

This is massive validation. Brazil isn’t a startup. It’s a BRICS nation with 215 million people and a government that’s increasingly wary of foreign digital surveillance. They’re not trusting Silicon Valley. They’re trusting QSE.

The message is clear: Digital Sovereignty is the new battleground, and QSE is selling the locks, keys, and vault doors. Governments that wait will be the ones scrambling when quantum decryption goes live.

Read this and more news for Quantum Secure Encryption Corp. at: https://usanewsgroup.com/2024/04/26/the-currency-of-tomorrow-why-investing-in-cutting-edge-ai-recognition-tech-could-mean-big-money/

THE SPEED OF WAR – NASDAQ: VWAV

VisionWave Holdings Inc. (NASDAQ: VWAV)

In modern warfare, Latency is Death. The difference between a successful missile interception and a smoldering crater isn’t firepower—it’s reaction time. And right now, the US military has a critical bottleneck: semiconductor design cycles that take months when battlefield reality demands seconds.

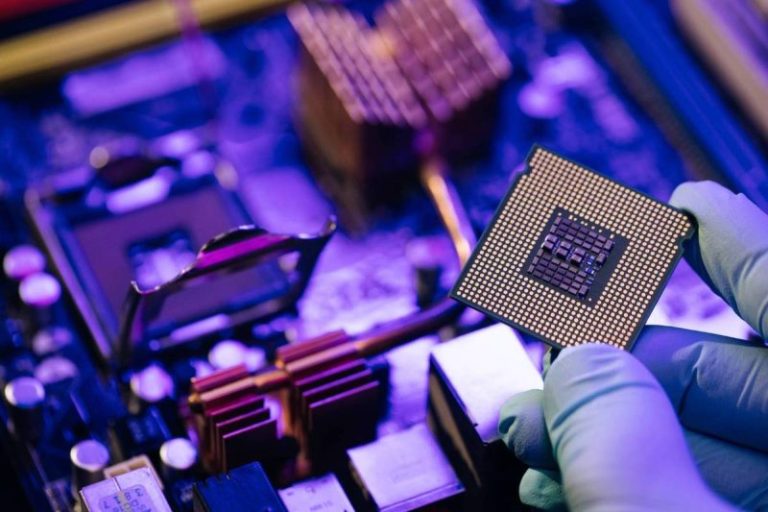

Every advanced weapons system, every drone swarm, every hypersonic defense platform runs on custom chips. But when those chips fail in the field—or when new threats emerge—the Pentagon can’t wait 90 days for a design revision. They need fixes now. That’s where VisionWave comes in.

The company is nearing completion of AstraDRC, an automated semiconductor design tool that fixes chip errors automatically—no human engineers required, no months-long debugging cycles. This isn’t about incremental improvement. It’s about collapsing the kill chain from minutes to seconds.

And on February 3, 2026, VisionWave made a move that signals they’re deadly serious: they acquired the QuantumSpeed computational engine, valued at $99.6 million. This isn’t vaporware. QuantumSpeed is the processing backbone that makes real-time chip design possible—turning VisionWave into the company that can redesign battlefield systems on the fly.

Think about what that means. A Chinese hypersonic missile with a new electronic signature? VisionWave’s tech could design a countermeasure chip during the flight path. A compromised drone network? Patch the silicon before the enemy knows you’ve adapted.

The Pentagon doesn’t buy ‘nice-to-haves.’ They buy mission-critical infrastructure. And VisionWave is now sitting at the chokepoint between defense readiness and obsolescence.

Read this and more news for VisionWave at:

https://usanewsgroup.com/2025/09/11/the-ai-defense-technology-developments-potentially-relevant-in-2025-26/

THE BIOLOGICAL REALITY – TSXV: VPT

Ventripoint Diagnostics (TSXV: VPT) (OTCPK: VPTDF)

Healthcare systems are collapsing under their own weight. Hospitals can’t afford million-dollar MRI machines. Rural clinics can’t recruit cardiologists. Indigenous communities have zero access to advanced diagnostics. And governments are running out of money to paper over the gaps.

The only way out is AI-driven efficiency that replaces expensive hardware with software intelligence. Ventripoint has cracked that code.

Their technology turns standard 2D ultrasounds into MRI-grade 3D cardiac models—no radiation, no $2 million machines, no specialist required. It’s the medical equivalent of turning a flip phone into a supercomputer with a software update. And it works anywhere—from a Vancouver hospital to a remote clinic 500 miles from the nearest paved road.

Proof? Their partnership with Nisga’a Valley Health Authority, announced January 29, 2026. This isn’t a pilot program in a wealthy metro area. This is remote Indigenous care—the ultimate stress test for ‘Hub-and-Spoke’ medicine. If Ventripoint’s tech works in the Nass Valley, it works everywhere.

Investors clearly believe it. Demand for their recent private placement was so intense they doubled the raise to $1 Million. That’s not hype. That’s capital flowing toward the only healthcare model that survives the Medical Scarcity Crisis.

Governments face a brutal choice: spend billions on hardware they can’t maintain, or invest in AI diagnostics that democratize advanced care at a fraction of the cost. Ventripoint isn’t competing for market share. They’re replacing the entire paradigm.

When the next pandemic hits—or when aging populations overwhelm cardiac wards—systems running Ventripoint’s platform will keep functioning. Everyone else will be triaging in hallways.

Read this and more news for Ventripoint Diagnostics at: https://usanewsgroup.com/2025/11/21/the-mri-grade-disruption-hiding-in-plain-sight-why-the-smart-money-is-watching-ventripoint

THE MONETARY ANCHOR – TSXV: RUA,OTC:NZAUF

Rua Gold Inc. (TSXV: RUA,OTC:NZAUF) (OTCQB: NZAUF)

When digital currencies collapse—and they will—central banks don’t reach for Bitcoin. They reach for Gold. It’s the only asset that has survived every currency crisis, every regime change, every empire’s fall. But here’s what most investors miss: strategic defense needs more than monetary metals. It needs Antimony.

Antimony is the unsung metal in flame retardants, military armor, and ammunition production. China controls over 60% of global supply. And just like rare earths, they’ve proven they’ll weaponize that control when geopolitics heat up.

Rua Gold has both. Their Auld Creek Project in New Zealand isn’t just a gold deposit—it’s a dual-threat asset with significant antimony mineralization. And the smart money knows it. On January 28, 2026, RUA closed a massive C$33 Million Financing. That’s not retail speculation. That’s institutional capital flooding into a company that controls monetary insurance and defense-critical supply in one package.

But here’s the kicker: RUA is targeting inclusion in New Zealand’s ‘FAST TRACK’ permitting process, announced January 19, 2026. This isn’t bureaucratic theater. Fast Track is reserved for projects the government considers economically essential. Translation: Wellington wants this mine built now.

Gold backs currencies. Antimony builds missiles. RUA controls both pipelines. When the next monetary crisis hits—or when defense stockpiles run dry—governments won’t be negotiating. They’ll be panic-buying from whoever has the metals in the ground.

RUA isn’t waiting for permission. They’re preparing to become the supplier governments can’t afford to ignore.

Read this and more news for Rua Gold at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

THE STRATEGIC CHOKE POINT – CSE: ARS

Ares Strategic Mining (CSE: ARS) (OTCQX: ARSMF)

The United States cannot build F-35 fighter jets without Fluorspar. It cannot produce advanced steel. It cannot manufacture the aluminum alloys that go into everything from tanks to telecommunications infrastructure. And right now, China controls the global supply.

This isn’t a market inefficiency. It’s a national security crisis. The Pentagon knows it. Congress knows it. And on January 20, 2026, they did something about it: Ares Strategic Mining secured a multi-year Pentagon contract with an estimated initial value of ~$169 Million, potentially rising to $250 Million.

Read that again. The US Department of Defense just handed Ares a nine-figure contract to supply domestically-produced fluorspar. This isn’t a ‘mining play’ anymore. It’s a National Security Mandate.

Ares didn’t waste time. On January 27, 2026, they announced they are immediately accelerating flotation plant construction to meet Pentagon demand. No delays. No feasibility studies. The government needs fluorspar now, and Ares is the only US-based supplier capable of delivering at scale.

This is the ultimate choke point. China can cut off exports tomorrow, and every US defense contractor would grind to a halt within months. Ares is the strategic bypass—the only pipeline that keeps American steel mills, aircraft manufacturers, and defense contractors operational when geopolitical tensions spike.

The Pentagon doesn’t sign $250 million contracts with companies they think might succeed. They sign them with mission-critical suppliers they cannot afford to lose.

Ares isn’t competing for market share. They’re replacing foreign dependency with sovereign supply. And in 2026, that’s the only investment thesis that matters.

Read this and more news for Ares Strategic Mining at: https://usanewsgroup.com/2024/04/29/this-company-is-bringing-essential-mining-back-to-the-u-s-fueled-by-government-action/

CONTACT:

USA NEWS GROUP

info@usanewsgroup.com

(604) 265-2873

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (MIQ). This article is being distributed for Baystreet.ca Media Corp. (BAY), who has been paid a fee for an advertising contract with Rua Gold Inc. ($45,000 CAD for a three month contract subject to the terms and conditions of the agreement from the company direct) and Ventripoint Diagnostics Ltd. MIQ has been paid a fee for QSE – Quantum Secure Encryption Corp., VisionWave Holdings, Inc., and Ares Strategic Mining Inc. (fee since expired) advertising and digital media from the companies directly or through affiliates. There may be 3rd parties who may have shares of these companies and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled companies. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ/BAY owns shares of QSE – Quantum Secure Encryption Corp. (purchased via private placement) , VisionWave Holdings Inc., Ventripoint Diagnostics Ltd. , and Ares Strategic Mining Inc. (purchased in the open market and/or private placements). They do not currently own shares of Rua Gold Inc. but reserve the right to buy and sell, and will buy and sell shares of all mentioned companies at any time without further notice. All material disseminated by MIQ has been approved by the mentioned companies. Technical information relating to Rua Gold Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person who is the COO of the company and therefore not independent. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful: investing in securities carries a high degree of risk; you may likely lose some or all of the investment.